Tuition & Financial Aid

At MMFS, we believe that all students should be able to access the highest-quality education possible, especially children with learning disabilities, for whom the appropriate options for high-quality educational opportunities are frequently unavailable.

Tuition and payment information

MMFS students receive the instruction and support they need to be successful. Classes are small; the average student to teacher ratio is 6:1. Students receive support services, including college guidance, language therapy, and fine/gross motor sensory therapy. Assistive and supporting technology is integrated at every level to facilitate instruction and learning. Tuition for the 2024-2025 school year is $83,276, and multiple payment plans are available.

Financial assistance application process

Financial aid applications for MMFS are handled through Blackbaud Financial Aid Management. To apply for financial aid for the 2024-2025 school year, you must complete the Blackbaud application online and submit all required documents. Financial aid is awarded based on demonstration of need and the availability of funds.

Financial aid applications for the 2024-2025 school year must be completed by September 1, 2024 in order to be considered for an award. The only exception to this deadline is if you have not received a decision or settlement notice for the 2023-2024 school year from the Department of Education by that date.

Financial assistance FAQs

Who can apply for financial assistance?

MMFS strives to award financial aid to as many students as possible, using a needs-based assessment. If you believe your financial resources are not sufficient to meet the cost of an MMFS education, you are strongly encouraged to apply for financial assistance. You can find the school’s full financial aid policy by clicking here.

Does applying for financial aid influence the admission decision?

No. MMFS does not take financial need into consideration when determining a student’s eligibility for admission. The admissions and financial assistance processes are separate and distinct. No decisions regarding financial assistance are made until a student is accepted.

How do I apply for financial assistance?

To apply for financial assistance for the upcoming school year, families must complete the Blackbaud Financial Aid Management application online and submit all required documents. All information will be shared with the MMFS Financial Aid Committee, and is kept in strict confidence. After completing the application, you will be asked to upload a number of supporting documents, including your latest federal tax returns, any business K-1s, Schedule Cs, and other documentation requested by the school or Blackbaud. Financial aid documents sent directly to the school will not be accepted or considered.

Financial assistance is awarded based on the demonstration of need and the availability of funds. Applications for an upcoming school year must be completed by September 1st in order to be considered for an award. The only exception to this deadline is if you have not received a decision or settlement notice for the prior school year from the Department of Education by that date.

What is the deadline for applying for financial assistance?

Financial aid applications for the 2024-2025 school year must be completed by September 1, 2024 in order to be considered for an award. The only exception to this deadline is if you have not received a decision or settlement notice for the 2023-2024 school year from the Department of Education by that date. It is important to apply as early as possible, as requests for financial assistance may exceed the funds available.

How much assistance can I get?

Financial assistance applications are reviewed by the school’s Financial Aid Committee after all documentation has been provided. Assistance is based on financial need and is given on a first-come, first-served basis. Assistance typically ranges from $5,000 to $25,000, depending on demonstrated need. Last year 27% of our students received some form of financial assistance.

Can I appeal a financial assistance decision?

Families who are denied financial assistance or have questions about their award may submit an appeal in writing within ten (10) days of receiving the decision. An appeal does not guarantee that the original award of aid will change. Only one appeal is allowed. The appeal should take the form of a letter, which must be specific and contain new information that was not in the original financial assistance application. The new information must be quantified and documented. All Financial Assistance Committee decisions regarding appeals are final.

Do I have to apply for financial assistance each year?

Yes. Families seeking financial assistance must apply annually. In order to be eligible for financial assistance, you must meet financial assistance criteria established by MMFS and by Blackbaud. A continued need must be demonstrated each year. While it is the goal of the Financial Aid Committee to maintain funding consistently from year to year, the decision is always subject to current documented need and established criteria. Receipt of an award in any year is not a guarantee of a future award.

I heard that I can get tuition reimbursement from the Department of Educations (DOE). What is that, and how can I get it?

Students who are eligible for special education, as determined by NYC’s Committee on Special Education, can receive tuition reimbursement from the DOE via Carter or Connors Funding. For more information, click here. Most MMFS students receive Carter funding; a few students receive Connors funding each year.

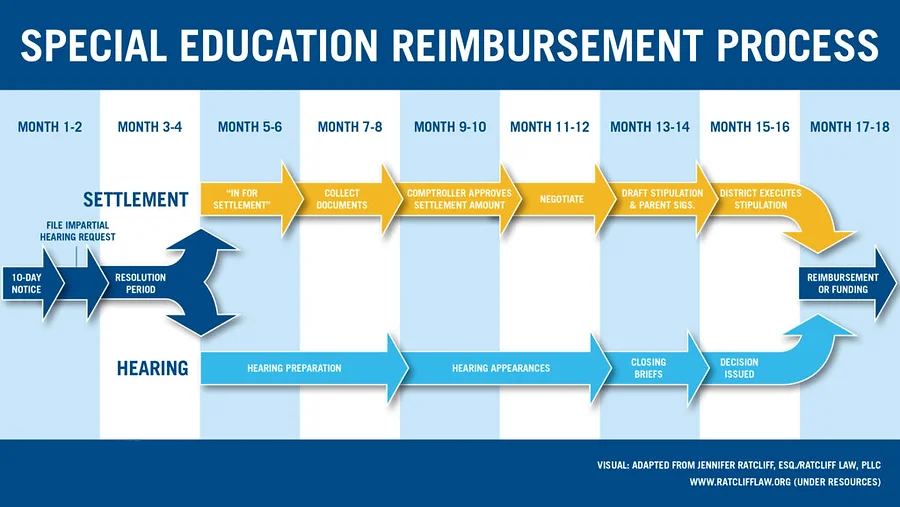

Carter funding (from the 1993 U.S. Supreme Court Case Florence County School Dist. Four v. Carter) involves reimbursement of tuition to the family from the Department of Education for an independent school education. The family pays the tuition up front and seeks reimbursement from the NYC DOE at an impartial hearing. If successful, the DOE will reimburse the family. According to the leading special education law firms, 98-99% of all NYC tuition reimbursement lawsuits win or settle an impartial hearing. Winning means full reimbursement, and settlement is generally at rates exceeding 90% of the cost. Please note that it can take up to two years or more following a settlement or a win for families to receive reimbursement. Therefore, special education law firms advise families to have at least two years of tuition accessible.

All tuition reimbursement cases are done on an annual basis at independent schools, including Mary McDowell Friends School. This requires families to file a lawsuit every school year, and therefore retain lawyers and incur legal fees on an annual basis.

Connors funding (from the 1998 U.S. District Court for the Northern District of NY case Connors v. Mills) requires school districts to pay tuition directly to the independent school. A family that is eligible for Connors funding doesn’t have to pay tuition and wait for reimbursement. Connors funding is specifically for families without the financial means to afford the tuition of independent schools.

Families who seek Connors placement for their child must submit an application annually (or confirm that their financial information has not materially changed since the last time they provided the school with their financial documents), which includes financial records that will be reviewed by the school’s Financial Aid Committee.

Each year MMFS will require a family to complete a financial aid application or confirm that their financial information has not materially changed since the last time they provided the school with their financial documents.

Where can I find help to pay for my child’s tuition?

Some possible options to consider:

- Short-Term Borrowing: When there is an expectation that reimbursement funds from the DOE will become available in the not-too-distant future, some families use short-term borrowing against vehicles such as their home’s equity, retirement funds, and credit unions. While these types of loans or lines of credit can carry higher interest rates, they can be helpful in the short term to bridge the gap between paying the tuition due and getting reimbursed.

- Tuition Financing: There are some financial institutions that offer K-12 educational loans. Parents can use these loans to help bridge the gap between paying tuition and receiving reimbursement from the NYC DOE.

- Interest Bearing: Your Tuition Solution (YTS) – MMFS has partnered with YTS to help parents interested in financing their child’s tuition with a loan. YTS offers interest-bearing loans based on the creditworthiness of the applicant. YTS can be accessed at https://www1.yourtuitionsolution.com/family. Qualifying families may borrow anywhere from $2,000 to $50,000 at various rates and for various payback periods.

- Interest Free: HFLS – HFLS offers interest-free special education bridge loans to low- and moderate-income residents of NYC, Westchester, and Long Island. HFLS takes into account a family’s income and the student’s DOE case status when determining loan eligibility. If you would like more information about the HFLS special education bridge loan, please contact Ivy Ip at iip@hfls.org or 212-706-0041, or click here.

Learn more about the process and timeline for pursuing tuition reimbursement from the DOE in the HFLS webinar Bridging the Gap: Securing Funding While Awaiting DOE Payout, designed for parents of children with special needs, in partnership with the Law Offices of Adam Dayan, PLLC.